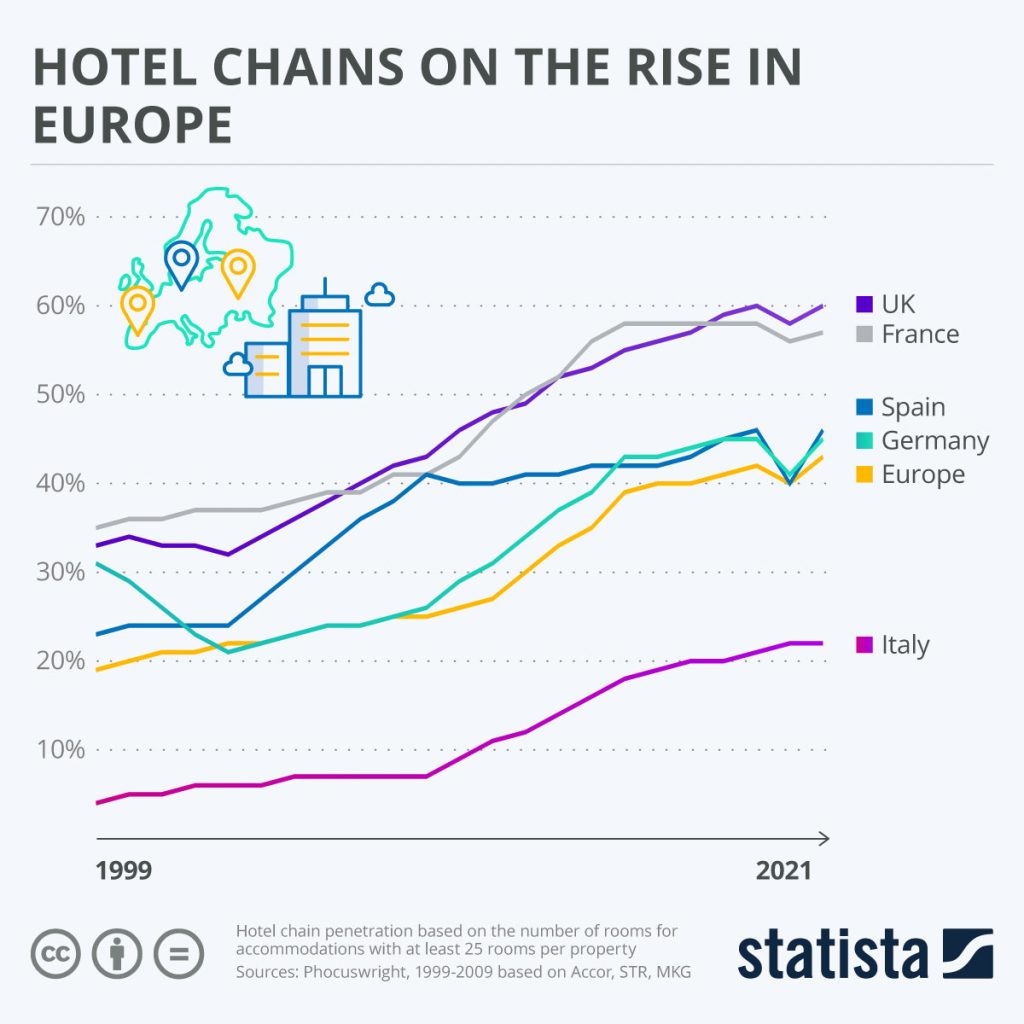

Despite having a larger room-share in Europe, hotel chains there have not yet grown to the same size as they have in the US. The chainification of the hotel business first occurred in France and the United Kingdom in 1999. In just two decades, the chain hotel penetration rate increased from less than 40% of available rooms to approximately 60%. Over this time, hotel chains have grown significantly, even in Italy, but independent hotels still account for more than 75% of the country’s hotel rooms.

Travel Weekly reported, Hotel behemoths Marriott International and Hilton have benefited from Europe’s summer travel boom, with both citing the return of international travel to Europe as a major revenue driver during the second quarter.

Leeny Oberg, CFO of Marriott, stated that Europe experienced “the fastest RevPAR recovery of all of our areas this year” in a call with analysts on August 2. In June, Marriott’s RevPAR in Europe exceeded 2019 levels, a 57 percentage point gain over January, she continued.

During Hilton’s second-quarter results call in late July, Hilton CEO Chris Nassetta echoed Oberg’s remarks and called the region’s quick recovery “a significant surprise.”

According to Nassetta, “Europe is on fire, with a significant boom in business.” Europe is now moving ahead of 2019.

Along with European demand, a notable recovery in business travel and group demand, notably in regions like the U.S. and Canada, supported both companies in the quarter.

Because to a resurgence in demand “across all industries,” Nassetta claims that Hilton witnessed U.S. business travel RevPAR reach past peak levels in June. Group reservations also began to improve during the quarter.

The percentage of business meetings is rising, and the group composition is starting to normalise, according to Nassetta. The pipeline for company meetings is tentatively up significantly from 2019 thanks to stronger bookings each month of the quarter.

When discussing group demand, Marriott CEO Tony Capuano had a similarly upbeat prognosis, telling investors that the company’s U.S. and Canadian group RevPAR for the month of June was down just 1% from June 2019; in contrast, it had been down 17% in March.

Capuano described the speed of the corporate travel acceleration as “more moderate.”

According to Capuano, “the small- and medium-sized firms are back above 2019 levels of volume.” Even if the larger corporate customers have not yet returned, improvements are still being made steadily, albeit perhaps not as quickly as we would like.

In the meantime, blended travel, sometimes referred to as bleisure or blended travel, was cited as a trend to watch by both Nassetta and Capuano.

According to Capuano, meeting organisers for corporations and associations have begun to ask about streamlining the process of reserving leisure trips.

According to Capuano, “they’ve asked us to do everything we can from a technological standpoint to make it easier for them to tack on a couple of leisure days to their reservation pre- or post-meeting, which was just another confirmation that this blended trip [trend] will likely endure well beyond the end of the pandemic.”