The hotel industry performance in the Asia Pacific region is seeing a gradual improvement in its performance, with the average daily rate (ADR) continuing to drive gains globally. However, despite these positive developments, occupancy rates are still lagging behind.

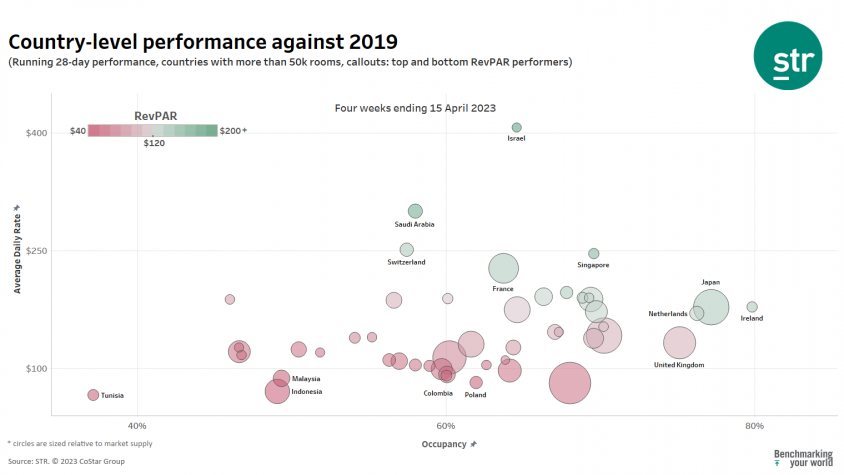

According to STR’s global “bubble chart” update as of April 15, 2023, the Asia Pacific region and over 50% of the world’s markets have shown more than 20% growth in revenue per available room (RevPAR) compared to 2019, with the increase being driven mainly by average daily rate (ADR). However, occupancy rates continue to lag behind pre-pandemic levels in most parts of the world.

Israel, Switzerland, Singapore, Saudi Arabia, and France had the highest RevPAR among countries with over 50,000 rooms, with Singapore leading the Asia Pacific region in RevPAR for the fourth consecutive 28-day period.

In terms of occupancy, Japan ranked second globally with a rate of 77%, following Ireland, with the Netherlands and the United Kingdom also posting occupancy rates above 75% due to Easter holiday travelers.

Indonesia, Colombia, Tunisia, Poland, and Malaysia had the lowest RevPAR due to lower domestic prices, with all five ranking at the bottom for ADR. However, only Tunisia was among the bottom five for occupancy, meaning these countries are not necessarily underperforming. In fact, Poland and Colombia reported occupancy rates ranked 24th and 29th, respectively, out of the 48 countries analyzed.

Hotel Industry Performance by Country-level

Throughout the pandemic, growth in revenue per available room (RevPAR) has mainly been driven by average daily rate (ADR), while occupancy rates have been slower to recover. This trend is further supported by the latest 28-day period, with 10 countries reporting occupancy levels more than 20% below their 2019 comparables, while only three countries saw a decrease in ADR.

Despite the pandemic’s impact on the hospitality industry beginning to fade, seven additional markets from the previous update still reported RevPAR levels behind those of 2019, bringing the total to 15 out of 48 countries analyzed. Some of these countries are struggling to increase their occupancy rates, with Germany and Vietnam experiencing declines of 19% and 20%, respectively, compared to 2019.

The content highlights the impact of exchange rate fluctuations on the average daily rate (ADR) in certain countries, namely Egypt, Argentina, and Turkey. These countries have experienced significant growth in their ADR due to these fluctuations. However, when excluding these regions, the top five markets in terms of revenue per available room (RevPAR) were the Italian Islands, Hainan, Portugal Provincial, Rio de Janeiro, and Saudi Arabia. These markets have benefited greatly from religious tourism.

On the other hand, the bottom five performing markets included two European locations, Munich and Switzerland Northwest. These markets experienced a decline of 55% and 43%, respectively, in their RevPAR. This decline can be attributed to various factors affecting their tourism industry.

Overall, the data shows that 75% of markets reported RevPAR levels higher than those in 2019. This positive trend has remained consistent since the beginning of 2023, with RevPAR levels consistently above 70%. This indicates a general improvement and recovery in the hospitality industry across multiple markets worldwide.

As stated in a previous STR Weekly Insights report, the effects of the pandemic on global performance are anticipated to diminish, leading to reduced fluctuations. However, this trend might not be applicable to specific Asian countries, specifically China and Japan. These countries had a delayed reopening due to the pandemic and are currently witnessing a surge in pent-up demand within their markets. This indicates that the recovery trajectory in these Asian nations might differ from the overall global trend, with a potentially stronger rebound in hospitality and tourism sectors as the demand continues to build up.

Source: STR

[…] represents a remarkable 22% increase compared to the previous year, showcasing the sector’s remarkable recovery. While this growth is commendable, it is essential to acknowledge the 23% decrease from 2019 […]