Due to Omicron limitations slowing down economic activity in this final quarter of the Indian fiscal year, the GDP of India increased by 4.1 percent in the first three months of 2022, somewhat truncating annual growth in 2021–2022 to 8.7 percent. Growth returned to 13.5 percent in the first quarter (April to June) of the current fiscal year.

Globally speaking, Indian GDP growth is still performing fairly well, and by 2030, it’s predicted that India will overtake Japan to become Asia’s second-largest economy.

In 2022, India’s GDP is expected to rise by 6.8 percent, according to the IMF. India was downgraded in the organization’s release this week, along with a number of other nations. The IMF nevertheless expected the nation to grow by 8.2 percent in April. With a GDP of $20 billion or more, this still ranks India in the top 10 fastest-growing economies in the world, although at rank 9, down from rank 4 in April. India ranks 20th when all countries are included, even little island states.

In all predictions, the IMF identified Guyana’s economy as having the fastest rate of growth. New oil exploitation initiatives are helping the country’s small population to expand. Ireland’s growth was also significantly revised up, although the little country’s GDP is notoriously unstable because of the several corporations with headquarters there that are utilising the advantageous tax laws within the EU.

High-growth Economies

Inflation and uncertainty

The world economy is currently facing a number of difficult obstacles. The future is adversely impacted by persistent COVID-19 epidemic, inflation that is greater than it has been in recent decades, tightening financial conditions across most of the world. As policymakers work to bring inflation back to target, monetary and fiscal measures that provided unprecedented assistance during the pandemic are being normalised. However, an increasing number of economies are experiencing a slowdown in growth or perhaps a contraction. The future health of the global economy heavily depends on how well monetary policy is calibrated, how the war in Ukraine plays out, and whether or not there could be additional supply-side disruptions brought on by pandemics, such as in China.

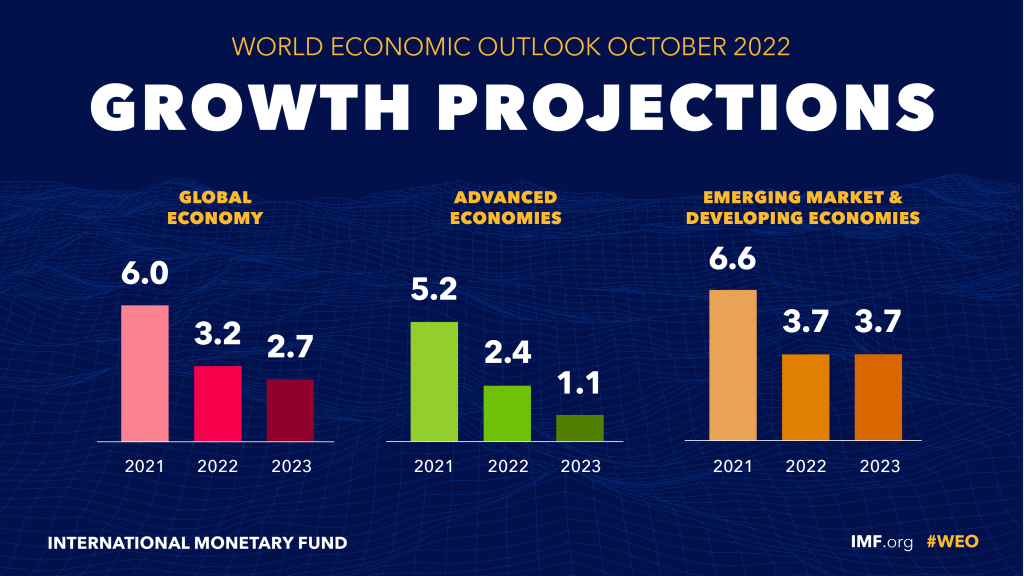

From 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023, global growth is anticipated to decline. With the exception of the global financial crisis and the early stages of the COVID-19 pandemic, this is the weakest growth profile seen since 2001 and it is due to significant slowdowns in the world’s largest economies, including a contraction of the US GDP in 2022’s first half, a contraction of the euro area’s GDP in 2022’s second half, and protracted COVID-19 outbreaks and lockdowns in China with an intensifying property sector crisis. Two straight quarters of negative growth are expected for around a third of the global economy. Forecasters predict that global inflation will increase from 4.7 percent in 2021 to 8.8 percent in 2022 before falling to 6.5 percent in 2023.

The future still carries extraordinarily high and negative risks. The ideal course of action for monetary policy may be miscalculated. The most developed economies’ divergent policy trajectories could result in greater strengthening of the US currency and increased conflicts between nations. Longer-lasting inflation could result from more abrupt changes in the price of energy and food. An increase in emerging market debt crisis could be brought on by global tightening of financial conditions. Russia’s suspension of gas shipments could reduce productivity in Europe.

Growth could be further hampered by a COVID-19 comeback or fresh health concerns around the world. A worsening of the crisis in China’s real estate market might have negative cross-border repercussions, affect the domestic financial industry, and have a significant impact on the nation’s GDP. Additionally, geopolitical fragmentation may obstruct trade and money movements, making it harder to coordinate climate policies. With a 25 percent possibility that global growth would be below 2.0 percent in the year ahead—in the 10th percentile of global growth outturns since 1970—the risks are heavily skewed to the downside.

Starting with monetary policy continuing on its current trajectory to restore price stability, these risks can be mitigated. As shown in Chapter 2, people and businesses base their wage and price expectations on their recent inflation experience, making front-loaded and vigourous monetary tightening essential to prevent inflation de-anchoring. The protection of vulnerable people through targeted short-term assistance is the top objective of fiscal policy in order to lessen the impact of the global cost-of-living problem.

But generally, it should maintain a restrictive enough posture to keep monetary policy on course. A significant improvement in debt resolution mechanisms is necessary to address the growing government financial distress brought on by slower growth and higher borrowing costs. Macroprudential policies should continue to be on watch against systemic risks as financial conditions tighten. Supply limitations would be relieved by stepping up structural changes to boost productivity and economic capacity, which would also aid monetary policy in containing inflation.

Policies to expedite the switch to green energy will have long-term benefits for energy security and the expenses associated with continuing climate change. The macroeconomic costs will remain reasonable by gradually implementing the proper remedies over the ensuing eight years, as Chapter 3 demonstrates. And finally, effective international collaboration will stop fragmentation from undoing the improvements in economic wellbeing brought about by 30 years of economic integration.

[…] have been able to raise their prices as tourism recovered across much of the world in 2022, largely driven by leisure. While the pent-up demand for in-person meetings and events can continue […]