Business travel, which was severely harmed during the pandemic, is showing signs of recovery. Will it, however, soon approach pre-pandemic levels? How will the return of internal meetings, client visits, and conferences be affected by the shift to remote work? How businesses and travel providers pivot to function in the new normal will be determined by the answers to these issues.

The transition from essential-only domestic business travel to more flexible domestic business travel has begun. If the pandemic situation in the United States continues to improve, corporate travel should experience a big increase in the fourth quarter of 2021. It will likely continue to improve at a quick pace through the end of 2022, barring major setbacks. As this important travel segment resurfaces, those who are affected face new obstacles in a changing environment. A health threat still exists, however it is more severe in some countries than in others. Even after the epidemic has passed, the reforms made and lessons acquired during the COVID-19 pandemic will have an impact on corporate travel. Many firms still rely on travel to expand. However, the cost-benefit equation for face-to-face meetings and events has been realigned and reevaluated. And C-level executives, who became more involved in travel planning as a result of the pandemic, will most certainly try to keep some of the cost savings and sustainability gains that a year without travel provided.

Travel companies must adjust to a new reality that includes fewer overall visits, a greater requirement to merge face-to-face and virtual interactions in a hybrid format, and a greater emphasis on the relationship-building element of business travel. While the entire recovery of US corporate travel will take more than a year, the following months will provide an opportunity to deepen connections and demonstrate the ability to flourish in the altered world of business travel.

Conferences and trade exhibitions, which make for a large portion of business travel, are largely virtual. Many offices are still shuttered, limiting both sales and project-based corporate travel: Many clients, vendors, and partners have yet to open their doors to employees, let alone visitors, because companies find it difficult to invite staff to go on work trips.

Employee dissatisfaction with travel, as well as clients’ dissatisfaction with in-person interaction, could stymie travel’s return. The ongoing postponement or cancellation of industry events, as well as increasing airfares and hotel room charges, are all external drag issues.

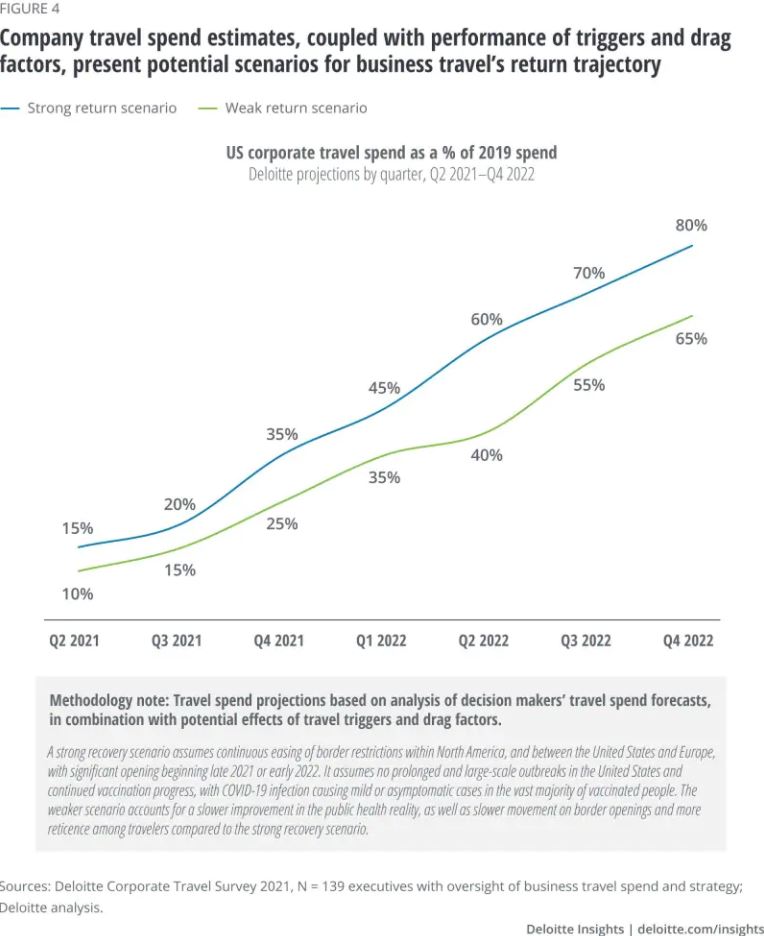

Travel’s return by quarter, Q2 2021 through Q4 2022

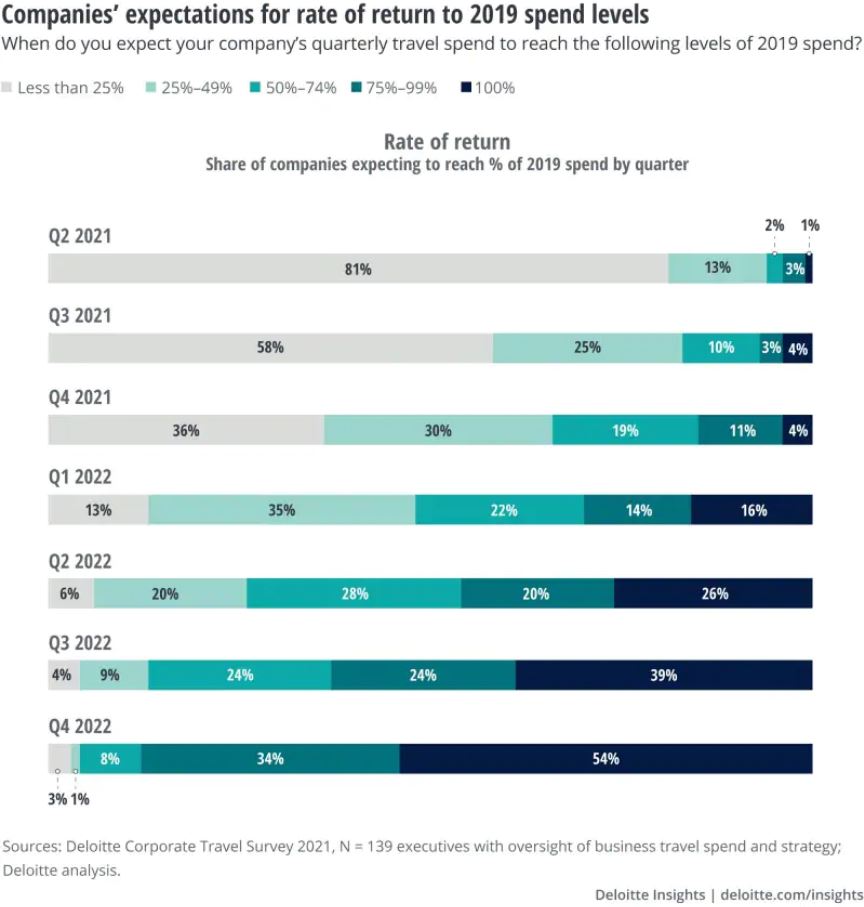

Deloitte generated a quarter-by-quarter view of corporate travel’s return, taking into account the most important triggers and potential drag factors, as well as firms’ travel spend forecasts through the end of 2022. As a proportion of their 2019 quarterly spend, survey respondents and interview participants projected when their organisations will hit various benchmarks (figure 3). In Q2 2021, only around a quarter of a percent of businesses had spent even a fourth of what they had spent in 2019. Nearly half of respondents say they do not anticipate to achieve 2019 spending levels by the fourth quarter of 2022, but nearly nine out of ten say they plan to reach 75% or higher.

Most organisations have yet to resume extensive business travel when the research was performed in May and June of 2021. More than two-thirds of survey respondents claimed their organisations had spent less than 25% of their 2019 budget. Executive interview subjects were significantly lower, concentrated among large corporations with an average pre-pandemic air spend of US$123 million. Many had boosted travel in the second quarter, but only little, following a year in which most had seen their spending fall by more than 90%. The smaller organisations in the poll will resume travel at a faster rate than the larger companies in the interviews, based on both current spending and estimates. The following quarter-by-quarter estimates rely on both the survey and the interviews (figure 4).

How the pandemic is reshaping corporate travel ![]()

Source: Deloitte Insights