Post lockdown, flexibility will be critical to success in the first year of the restart, says Brian Pearce (Chief Economist). Below are some of the analysis done in numerous aspects that could provide some clarity where the industry stands as of now. These statistics enable us to predict the travel industry as a whole, what international travel landscape and its foreseeable future, as well as its repercussions on the travel industry in general.

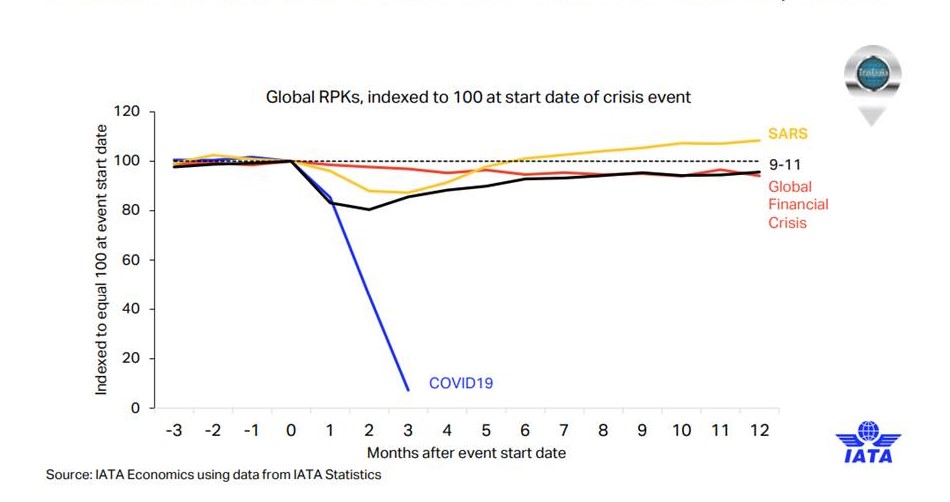

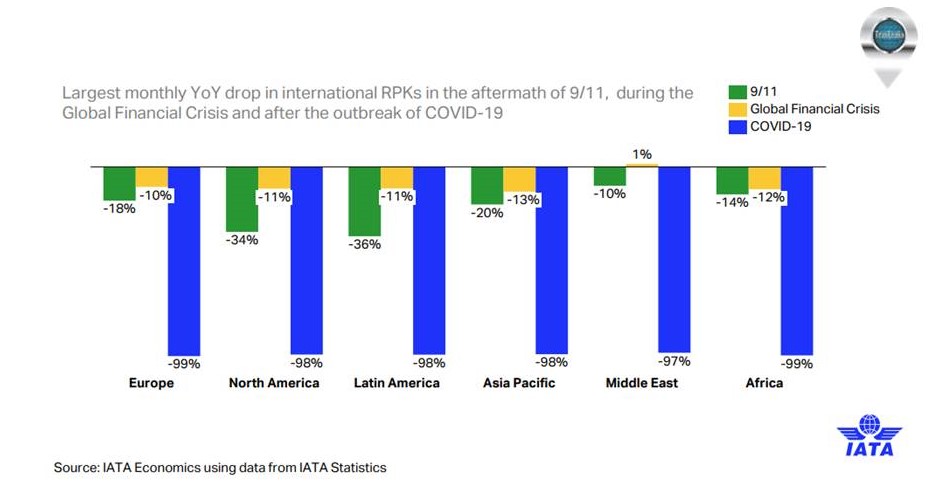

Depth of COVID19 impact far exceeds previous crises

RPKs 20% fall after 9-11 and 12% after SARS vs 95% fall in April 2020

Previous crises allowed diversion to stronger regions

No such flexible response in fleet deployment possible this time

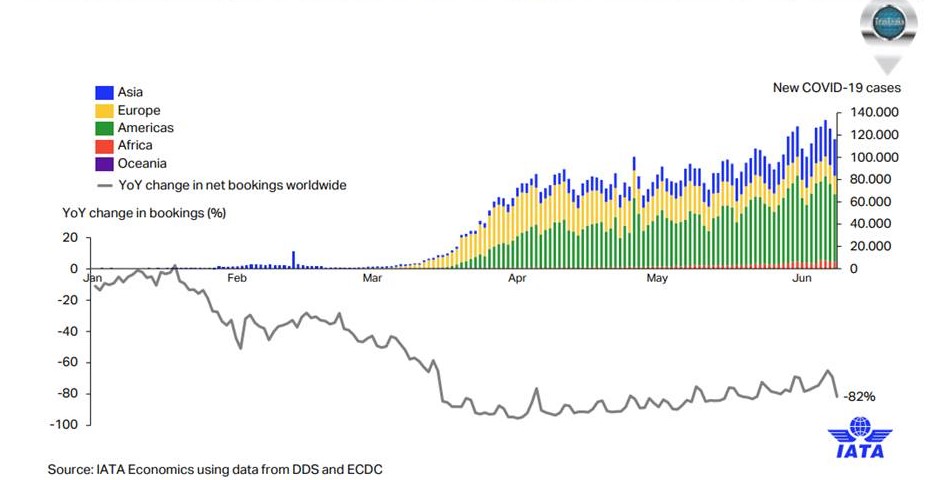

1st wave of COVID-19 far from over & bookings are low

Airlines cannot plan schedules for N Winter season with any certainty

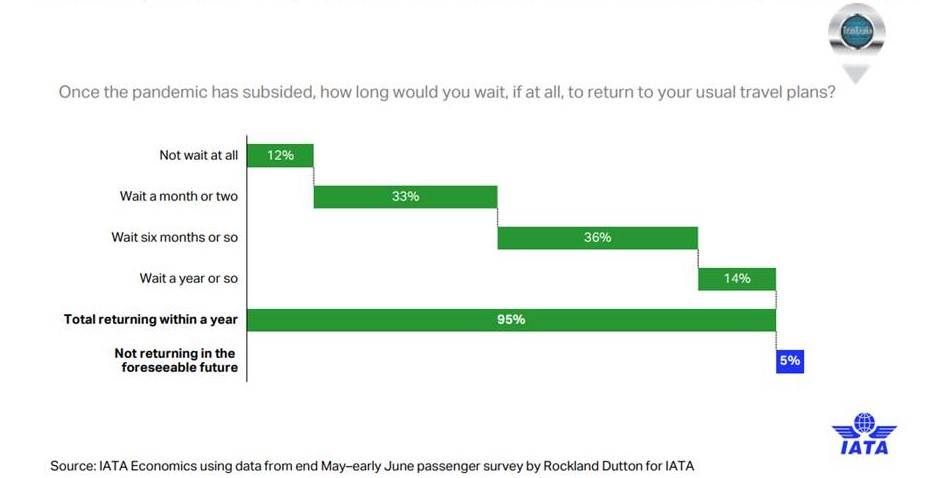

The latest survey shows passengers even more cautious

Now only 45% will fly within 1-2 months. The previous survey shows 60%

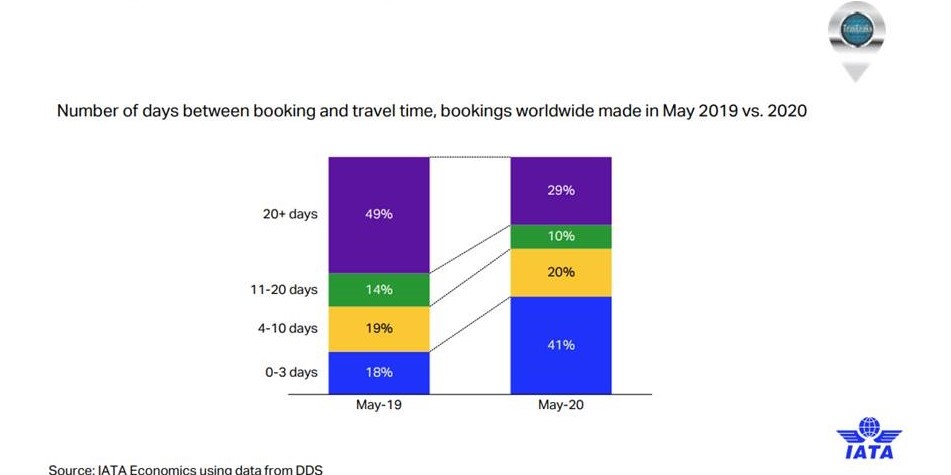

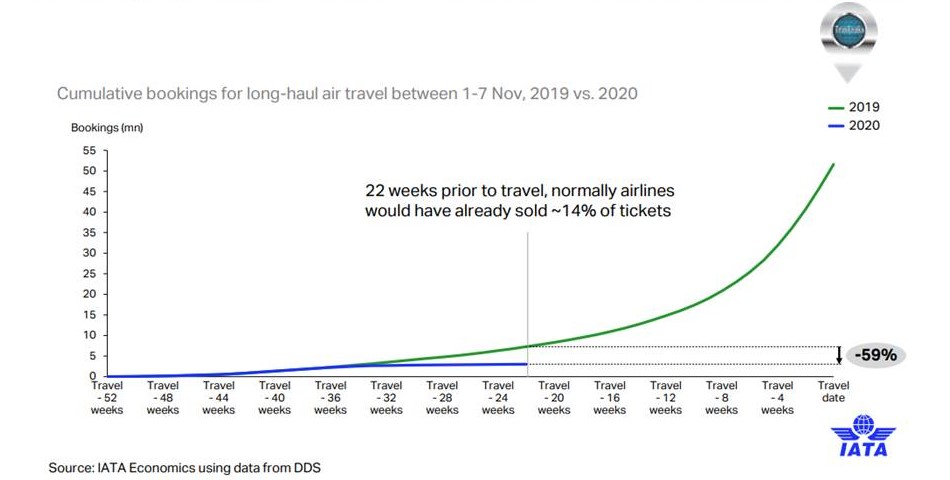

Airlines have even less visibility from forward bookings

Passengers are booking flights much later. 41% only 0-3 days ahead.

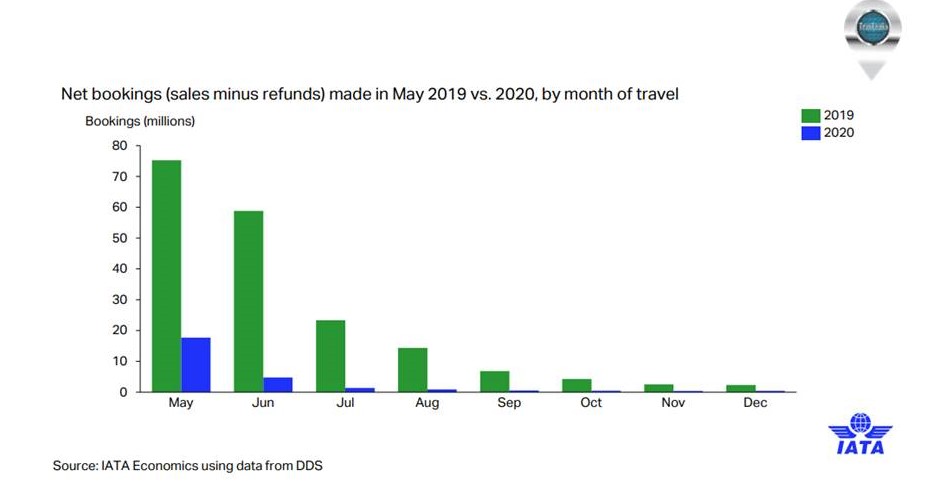

No sign of a rapid return to travel even in summer months

Airlines must plan winter schedules now but zero visibility of demand

- How air travel is dominated by a small number of frequent flyers

According to new research reported by the BBC by climate advocacy group Possible, a limited number of frequent flyers dominated… Read more: How air travel is dominated by a small number of frequent flyers

According to new research reported by the BBC by climate advocacy group Possible, a limited number of frequent flyers dominated… Read more: How air travel is dominated by a small number of frequent flyers - Crushing Impact on International Tourism

World Tourism Day is observed each year on September 27 to “foster awareness among the international community of the importance… Read more: Crushing Impact on International Tourism

World Tourism Day is observed each year on September 27 to “foster awareness among the international community of the importance… Read more: Crushing Impact on International Tourism - Vanishing traffic, a collapse in revenues, and rising business risks for Global Airports

A recent report from Airports Council International (ACI) has now revealed significance of COVIDE-19 impact on global civil aviation business… Read more: Vanishing traffic, a collapse in revenues, and rising business risks for Global Airports

A recent report from Airports Council International (ACI) has now revealed significance of COVIDE-19 impact on global civil aviation business… Read more: Vanishing traffic, a collapse in revenues, and rising business risks for Global Airports

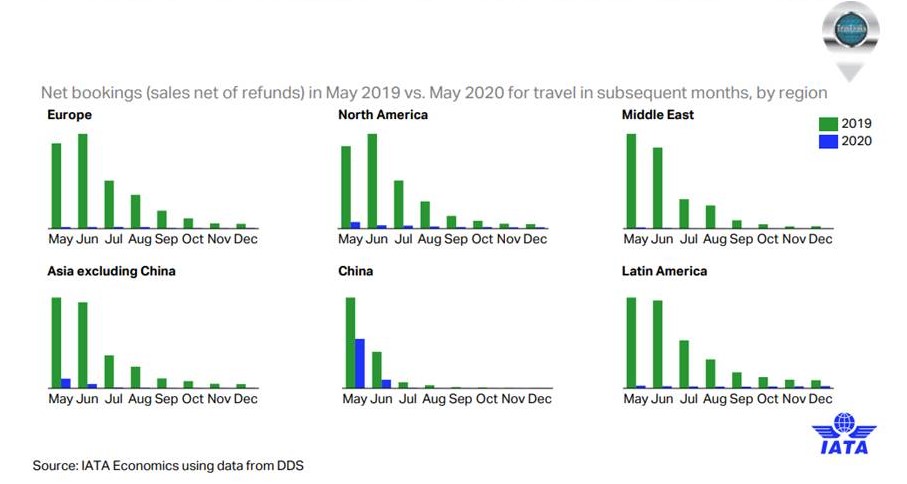

Lack of demand visibility widespread across regions

Airlines have little evidence on which to schedule restart network

Demand for long-haul travel remains close to zero

Normally airlines would have sold 14% of tickets for the start of the winter season

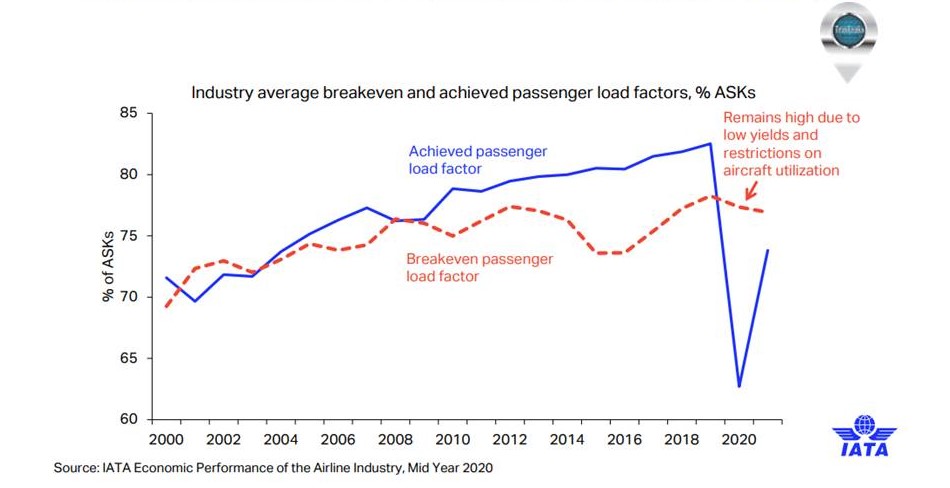

Load factors likely to remain well below breakeven

Without schedules flexibility airlines will be unable to fill seats

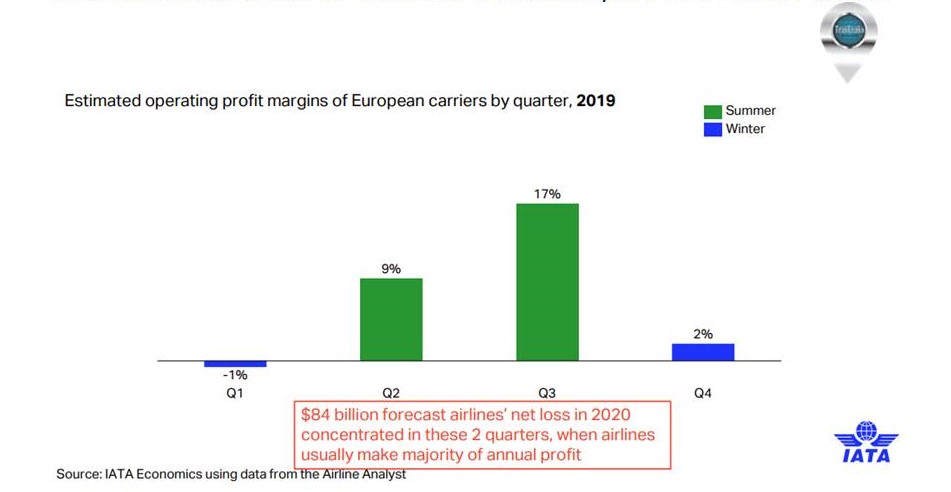

Lack of summer cash flow adds to a fragile situation

Airline business seasonal with cash flows always weak in the winter season

The key to survival in the winter season will be flexibility

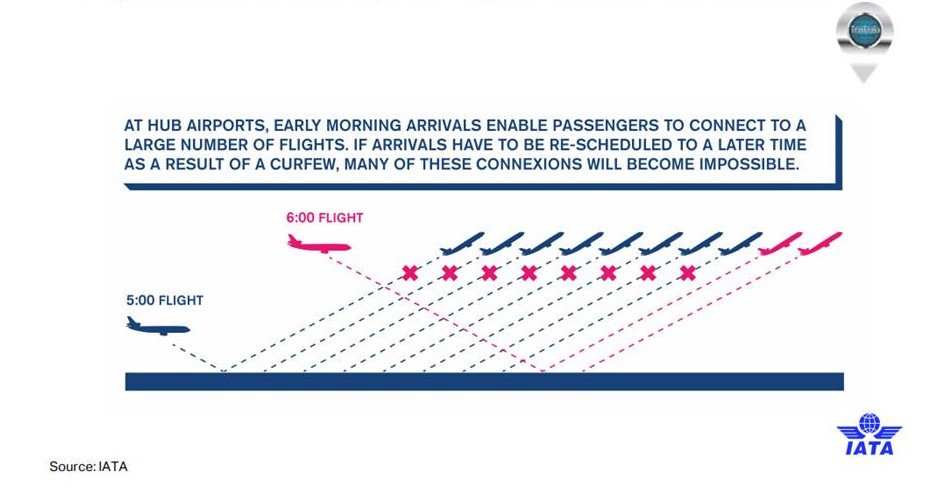

An extended waiver on 80:20 slots rule needed to give the necessary flexibility

If slots lost, long-haul connectivity may not be restored

Flight banks at hub airports require certain slots at each end

So there is a risk that city-pair air connectivity will be lost

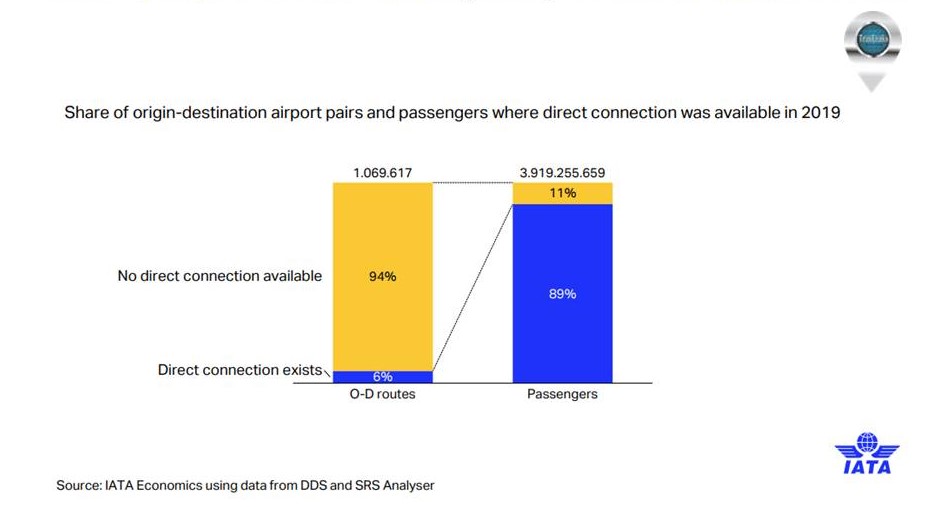

94% airport-pairs connect indirectly, though most travel on trunk routes

Follow us: