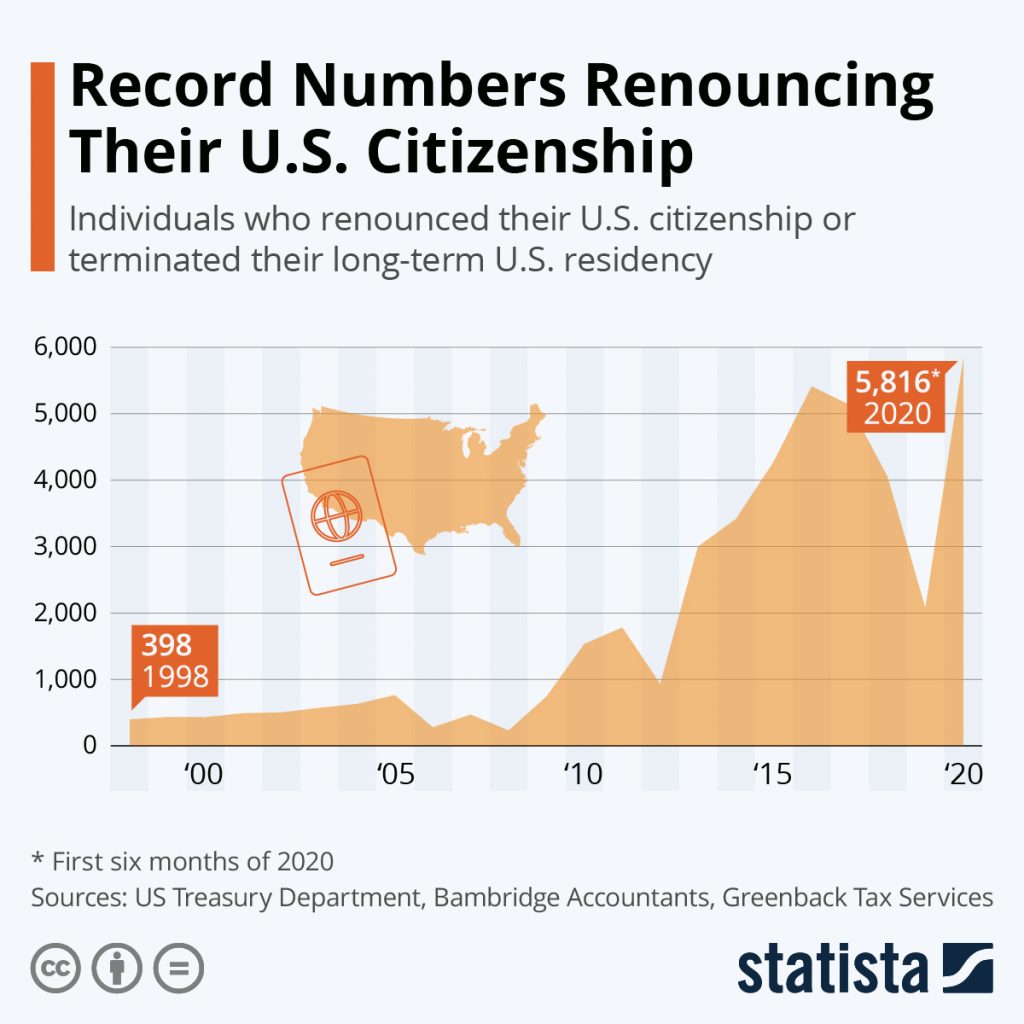

A record-breaking number of Americans renouncing their citizenship, according to recently released data. As per Statista report, Bambridge Accountants, a New York based tax firm, stated that 5,816 Americans relinquished their citizenship in the first half of 2020, while 2019 given up citizenship numbers were recorded as 2,072. American citizenship renouncing process involves payment of $2,350 government fee and expatriates have to present themselves in person at the U.S. embassy in their country of residence. Renunciation of citizenship is the voluntary act of relinquishing one’s citizenship and in accordance with IRS rules; the government publishes the names of all Americans who have given up their citizenship on a quarterly basis.

Americans give up their citizenship for several different reasons. Some blame the prevailing political situation at home and it is also possible that the government’s response to coronavirus pandemic is one of the primary reasons for this year’s drastic increase compared to 2019 numbers. Historically, tax has been one of the key reasons to renounce the citizenship. Maintaining tax file and providing foreign bank account details is mandatory for U.S. citizens living abroad, which is a discouraging factor that somewhat influences the decision of giving up the citizenship.

- Global Tourism Recovery 2023: Key Factors and Future Outlook

The COVID-19 pandemic severely impacted many industries, with the tourism sector being among the hardest hit. In 2020, deemed “the… Read more: Global Tourism Recovery 2023: Key Factors and Future Outlook

The COVID-19 pandemic severely impacted many industries, with the tourism sector being among the hardest hit. In 2020, deemed “the… Read more: Global Tourism Recovery 2023: Key Factors and Future Outlook - Discover the Beauty and Diversity of New Zealand’s Top Tourist Spots

New Zealand is a country that never fails to impress with its diverse range of tourist spots, each offering a… Read more: Discover the Beauty and Diversity of New Zealand’s Top Tourist Spots

New Zealand is a country that never fails to impress with its diverse range of tourist spots, each offering a… Read more: Discover the Beauty and Diversity of New Zealand’s Top Tourist Spots - The Travel & Tourism Economic Impact Reports: Shaping Global Economies

The Travel & Tourism industry has long been recognized as a key driver of economic growth and job creation across… Read more: The Travel & Tourism Economic Impact Reports: Shaping Global Economies

The Travel & Tourism industry has long been recognized as a key driver of economic growth and job creation across… Read more: The Travel & Tourism Economic Impact Reports: Shaping Global Economies

In addition to financial reporting requirements is the issue of double taxation. Unlike most countries, the U.S. has citizen-based taxation, meaning citizens are taxed regardless of where in the world they live and where they earned their income. While foreign tax credits can reduce the tax burden, they do not eliminate all double taxes, particularly for higher-income earners, who end up filing and paying taxes both in the U.S. and abroad.

Americans are increasingly feeling the impact of the coronavirus, both on their everyday lives and their financial well-being. As a result of the recently signed CARES Act , the majority of Americans started to see some financial relief through Economic Impact Payments (EIP) being issued by the Internal Revenue Service (IRS).