STR: How Asia Pacific hotels have performed in April 2020

SINGAPORE— Reflecting the effects of the COVID-19 pandemic, the Asia Pacific hotel industry reported record lows in the three key performance metrics during April 2020, according to data from STR.

U.S. dollar constant currency, April 2020 vs. April 2019

- Occupancy: -60.3% to 28.0%

- Average daily rate (ADR): -44.8% to US$54.97

- Revenue per available room (RevPAR): -78.1% to US$15.38

The absolute levels in each of the three KPIs were the lowest for any month on record in the region.

Local currency, April 2020 vs. April 2019

South Korea

- Occupancy: -70.8% to 20.0%

- ADR: -21.0% to KRW112,897.83

- RevPAR: -76.9% to KRW22,536.18

Each of the three key performance metrics were up from March but remained the lowest for any April on record in the country. Incheon & Seoul experienced a 75.2% year-over-year decrease in occupancy (to 18.8%).

Australia

- Occupancy: -72.7% to 19.9%

- ADR: -33.1% to AUD119.87

- RevPAR: -81.7% to AUD23.85

The absolute occupancy, ADR and RevPAR levels were the lowest for any month in STR’s Australia database. Among key markets, Melbourne and Sydney saw year-over-year occupancy declines of 65.0% and 73.7%, respectively. Returning travelers are predominantly keeping occupancy up, as seen in Adelaide, where year-over-year occupancy declines eased slightly during April up to 13 May due to returning travelers from India.

- Hotel Industry Performance in Asia Pacific: A Gradual Improvement, but Lagging Occupancy RatesThe hotel industry performance in the Asia Pacific region is seeing a gradual improvement in its performance, with the average… Read more: Hotel Industry Performance in Asia Pacific: A Gradual Improvement, but Lagging Occupancy Rates

- Would you ever Travel these the Most Violent Cities in the World?The world’s most violent cities, a disturbing reality that haunts the streets with terror and bloodshed. In these urban jungles,… Read more: Would you ever Travel these the Most Violent Cities in the World?

- High Growth Economies in 2022Due to Omicron limitations slowing down economic activity in this final quarter of the Indian fiscal year, the GDP of… Read more: High Growth Economies in 2022

Further, STR data analysis suggest that industry can see some lights end of the tunnel.

More information can be found in STR’s Pacific webinar recording.

Key takeaway from the above webinar

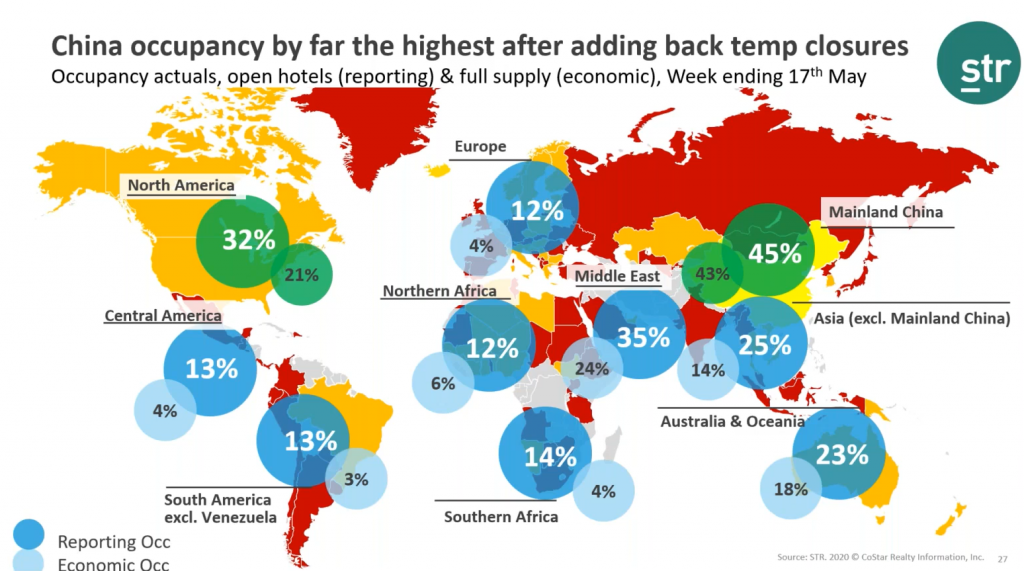

China Well underway domestically

- Occupancy growth trend continues – Now about continuing and managing the second wave.

- Driven by domestic demand of both leisure (first) then business.

Recovery cannot be rushed – Q2-Q3 hopeful, and domestic remain key driver

- Vietnam opening up, Australia and New Zealand combining forces

- US reopening

Recovery will vary – and rely on air capacity more in APAC

- So far small amounts of business on the books

- Airlines will in short to medium time frame not all have same capacity

Financial distress

- Banks, lessors and landlords are in for some serious conversations

- Without and explanation – your outlook will be very challenged

Additional COVID-19 analysis

A weekly video on China performance can be found here.

- Global Tourism Recovery 2023: Key Factors and Future Outlook

The COVID-19 pandemic severely impacted many industries, with the tourism sector being among the hardest hit. In 2020, deemed “the… Read more: Global Tourism Recovery 2023: Key Factors and Future Outlook

The COVID-19 pandemic severely impacted many industries, with the tourism sector being among the hardest hit. In 2020, deemed “the… Read more: Global Tourism Recovery 2023: Key Factors and Future Outlook - Discover the Beauty and Diversity of New Zealand’s Top Tourist Spots

New Zealand is a country that never fails to impress with its diverse range of tourist spots, each offering a… Read more: Discover the Beauty and Diversity of New Zealand’s Top Tourist Spots

New Zealand is a country that never fails to impress with its diverse range of tourist spots, each offering a… Read more: Discover the Beauty and Diversity of New Zealand’s Top Tourist Spots - The Travel & Tourism Economic Impact Reports: Shaping Global Economies

The Travel & Tourism industry has long been recognized as a key driver of economic growth and job creation across… Read more: The Travel & Tourism Economic Impact Reports: Shaping Global Economies

The Travel & Tourism industry has long been recognized as a key driver of economic growth and job creation across… Read more: The Travel & Tourism Economic Impact Reports: Shaping Global Economies - Experience the Best of City and Nature in Auckland, New Zealand’s Multicultural Hub and ‘City of Sails

Introduction Auckland is a city that effortlessly combines the best of urban sophistication and natural wonders. Located on the North… Read more: Experience the Best of City and Nature in Auckland, New Zealand’s Multicultural Hub and ‘City of Sails

Introduction Auckland is a city that effortlessly combines the best of urban sophistication and natural wonders. Located on the North… Read more: Experience the Best of City and Nature in Auckland, New Zealand’s Multicultural Hub and ‘City of Sails - The Impact of AI on Our Lives: Insights from a Global Survey

A recent Ipsos survey conducted for the World Economic Forum revealed that the majority of adults from 28 different countries… Read more: The Impact of AI on Our Lives: Insights from a Global Survey

A recent Ipsos survey conducted for the World Economic Forum revealed that the majority of adults from 28 different countries… Read more: The Impact of AI on Our Lives: Insights from a Global Survey