Global Hotel Behemoth prospects unfold with Accor Interest in Merger with IHG. Shares in French hotel group “Accor” rise after Le Figaro newspaper reported it had studied a potential marriage with London-listed rival InterContinental Hotels Group (IHG) that pave the way for the world’s biggest hotel group. Marriott is currently the world’s largest hotel group, following its merger with Starwood in 2016.

The report further said that possible merger of the two groups would complement each other in geographical presence, having the majority of IHG’s properties being located in China and the United State, and Accor being the leader outside of China and the US.

While the Global pandemic shakes the hotel industry and continues to worry professionals, the most resilient giants of the sector are looking for the best solution to emerge stronger from the crisis. According to publication, Accor has examined a merger project with its rival IHG. Accor CEO Sébastien Bazin, formed a team with Jean-Jacques Morin, his finance chief, and the investment banks Centerview and Rothschild to investigate a possible approach. Accor said the company does not comment on market rumours. IHG declined to comment.

The merge of two of the world’s biggest hotel companies would form the world’s biggest conglomerate to leapfrog Marriott International bringing over 11,000 hotels under one umbrella. In addition to complements that bring in a geographical sense, the marriage would create significant synergies in central functions, reservation systems, and the loyalty program. The strike force to attract customers and hotel owners looking for franchise and management contracts.

IHG operates 5,918 hotels (883,364 rooms) around the world with its flagship brands such as Intercontinental, Crowne Plaza, and Holiday Inn, with a heavy presence in the United States. As stated in the report, its turnover was 4.6 billion dollars (3.87 billion euros) in 2019, and it is valued at 7.3 billion pounds (7.8 billion euros) on the London Stock Exchange. Accor leads outside of China and the United States and valued at 6 billion euros, Accor operates 5,099 hotels (747,805 rooms) with their well-established brands like Raffles, Sofitel, Novotel, Mercure, Ibis, etc., its turnover was 4 billion euros in 2019.

Reuters reported Accor shares were up 1.9%. The company faces higher interest payments after it was downgraded to junk status by ratings agency S&P Global earlier this week, has been heart by investors this year, with its shares down over 43% so far.

“Shares in IHG, down around 23% this year, were up 0.35% at 0825 GMT after surging as much as 3.1% in early trading, outperforming a falling FTSE-100 index”, reported Reuters.

The Travleaks learned, both firms have announced job cuts and taken numerous cost-saving approaches in the recent past as they try to cope with the challengers erupted by the global pandemic.

It is evident that any merger would face hurdles from business commissions in the COVID-19 environment and even beyond. If successful merge takes place, the combined group with close to 60 separate brands, many of which would overlap its market segment, which leaves competing among its own brands.

- Global Tourism Recovery 2023: Key Factors and Future Outlook

The COVID-19 pandemic severely impacted many industries, with the tourism sector being among the hardest hit. In 2020, deemed “the worst… Read more: Global Tourism Recovery 2023: Key Factors and Future Outlook

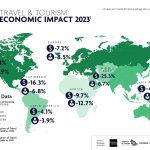

The COVID-19 pandemic severely impacted many industries, with the tourism sector being among the hardest hit. In 2020, deemed “the worst… Read more: Global Tourism Recovery 2023: Key Factors and Future Outlook - The Travel & Tourism Economic Impact Reports: Shaping Global Economies

The Travel & Tourism industry has long been recognized as a key driver of economic growth and job creation across the… Read more: The Travel & Tourism Economic Impact Reports: Shaping Global Economies

The Travel & Tourism industry has long been recognized as a key driver of economic growth and job creation across the… Read more: The Travel & Tourism Economic Impact Reports: Shaping Global Economies - Hotel Industry Performance in Asia Pacific: A Gradual Improvement, but Lagging Occupancy Rates

The hotel industry performance in the Asia Pacific region is seeing a gradual improvement in its performance, with the average daily… Read more: Hotel Industry Performance in Asia Pacific: A Gradual Improvement, but Lagging Occupancy Rates

The hotel industry performance in the Asia Pacific region is seeing a gradual improvement in its performance, with the average daily… Read more: Hotel Industry Performance in Asia Pacific: A Gradual Improvement, but Lagging Occupancy Rates